R N Bhaskar

February 24, 2014

India’s policymakers love to talk about ‘national interest’. They talk of it when they do not want to part with information. They say that it would jeopardise ‘national interest’. They love to curb individual freedoms, and even the freedom of the press in the name of ‘national interest’.

Another phrase India’s policymakers love to use selectively is “making the business environment investment-friendly”.

This was the phrase used when it came to justifying the horrendous rates of return (backed by sovereign guarantees) promised to the now departed Enron. This is what they say when it comes to allowing increased foreign direct investment in the aviation sector. This is the same tune the government sings when trying to permit foreign ships ply coastal trade in India. This is the argument used for creating special financial benefits for foreign investors, of which the most controversial is the Participatory Notes facility. And the list can be extremely long indeed.

But such phrases are conveniently forgotten when they shamelessly try to pass laws, with retrospective effect, to impose heavy tax burdens on select telecom players. It is a game of selectively doling out of bonanzas, and levying selective penalties. All this has actually made India appear more like a banana republic.

The biggest sellout is likely to be the modification of cabotage rules. Cabotage, as Wikipedia defines it, “traditionally refers to shipping along coastal routes, port to port, within the same country. Originally a shipping term, cabotage now also covers aviation, railways, and road transport. Cabotage is the exclusive right of a country to operate traffic within its territory”.

However, in 2012, the Indian government decided to allow one port, Vallarpadam, to be exempted from the application of cabotage rules, so that it could become a trans-shipment port. Indian registered ship-owners protested, but finally relented under government pressure and the invocation of ‘national interest’. Two years later, it is evident that trans-shipment from Vallarpadam has not increased significantly, but has begun to hurt Indian ship-owners.

Yet, by May last year, the government mooted a proposal to relax cabotage rules further, and extend this benefit to two more private ports – Mundra and Pipavav. The proposal is yet to become a policy.

Significantly, all the three ports have partners who virtually control much of the global freight traffic to and from India. Vallarpadam is managed by Dubai Port World (DPW). DPW also manages a berthing terminal at Mundra. Pipavav is owned by APM, which is owned by AP Moller-Maersk, one of the largest port and line operators in the world. A similar scenario could take place in the air as well, if the Jet-Etihad deal goes through as had been originally planned. The aviation deal is now being examined by the Supreme Court of India.

While India is willing to bend backwards, it is worth looking at what a free-trade supporter like the US does: Its cabotage rules are captured in the Jones’ Act which allows ships to operate between two ports in the US only if they (a) fly the US flag, (b) are constructed in a US shipyard, (c) are owned by the US citizens, and (d) are crewed by US citizens or permanent residents.

This is the way the US protects its labour, its waters, its shipbuilding manufacturing interests and its national business interests.

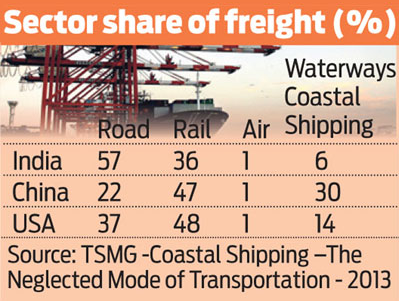

There is a great deal of interest in India’s cabotage. Its coastal business could increase several-fold within the next decade, if global trends are considered (see table/chart). After all, India has a vast coastline of 7,517 km and abundant rivers. Moreover, sea transport costs are less than a quarter compared to those of road transport. The twin benefits make coastal traffic a strategic business and economic opportunity for India. So why fritter it away?

If India has to grow, it must protect and promote – as the US does – its labour, manufacturing bases and business interests. Unfortunately, as in the Jet Airways case, this is another issue that could be headed for a Supreme Court hearing.

Click here to read the original article.

COMMENTS