Source: http://www.moneycontrol.com/news/business/economy/this-is-how-government-can-clean-up-gold-trade-and-make-it-both-healthy-profitable-2327393.html

Gold – III :

Three steps which can clean up the gold trade in India

(part-I can be found at http://www.asiaconverge.com/2017/07/india-loves-gold1/; and

part II at http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/)

Rn bhaskar Jul 17, 2017 02:40 PM IST | Source: Moneycontrol.com

The need for a fresh approach to gold is imperative. Here are a few recommendations which can be used to sort out gold trade.

Before one delves into the things that the government should, or should not, do, it is necessary to reiterate two key issues

- Indians love gold. It is backed by sentiment, custom and even religion. Banning gold ownership (as pursued under the now extinct Gold Control Act) is foolhardiness (see http://www.moneycontrol.com/news/business/economy/why-indias-part-illicit-love-affair-with-gold-will-sizzle-on-2324155.html) .

- Smuggling of gold into India becomes extremely attractive when import duty rates go above the normal cost of smuggling and money laundering. At 10% the government actually incentivises smuggling. With the addition of a 3% GST, the government makes gold smuggling extremely lucrative. The danger with smuggling is that it finances the creation of a smuggling channel – transportation agents, landing support, compliant officers, trade links etc. As this network becomes better and bigger, other things begin riding on this network. Drugs if oten the starting point. Arms smuggling to aid terrorism is the next (http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/)

- The sleazier and more entrenched the gold smuggling syndicate becomes, the less effective will the enforcement apparatus be. Raids in the past have yielded little. Government gets data that remains non-comnpliant with other sets of data. And the danger of government officials encouraged to become dishonest is always a possibility (http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/). And since the entire trade is mired in sleaze, each goldsmith begins contaminating gold with impurities. In 2006, the NSSO discovered that at least 90% of gold was contaminated to the extent of 13%. Today, it could be more widespread. Silver coins for example are in a worse situation. Almost 95% of silver coins are contaminated to the extent of (hold your breath!) 80%.

It is only when one takes these factors into account that the need for a fresh approach to gold becomes an imperative. Here are a few recommendations:

#1. A brilliant report was compiled by the Reserve Bank of India (RBI) almost five years ago. It was titled Report of the Working Group to Study Issues related to Gold Imports and Gold Loan NBFCs in India. It was chaired by K.U.B Rao (hence the report is also popularly referred to as the KUB Rao report) and was submitted to the government in February 2013. It stated quite forcefully that given the huge amounts of money involved, and the employment of over 3.5 million people, the gold sector would be best handled by a separate body. It proposed the formation of The Bullion Corporation of India (BCI) which could look at all aspects of gold, and create proper rules that could ensure both fair play and growth for the industry. Such a body would be manned by professionals who would be expected to be sector specialists. It would be along the same lines as other financial bodies that government had already created – like NABARD for the agricultural sector, or SIDBI for the promotion would be answerable to the RBI and to the finance ministry.

#1. A brilliant report was compiled by the Reserve Bank of India (RBI) almost five years ago. It was titled Report of the Working Group to Study Issues related to Gold Imports and Gold Loan NBFCs in India. It was chaired by K.U.B Rao (hence the report is also popularly referred to as the KUB Rao report) and was submitted to the government in February 2013. It stated quite forcefully that given the huge amounts of money involved, and the employment of over 3.5 million people, the gold sector would be best handled by a separate body. It proposed the formation of The Bullion Corporation of India (BCI) which could look at all aspects of gold, and create proper rules that could ensure both fair play and growth for the industry. Such a body would be manned by professionals who would be expected to be sector specialists. It would be along the same lines as other financial bodies that government had already created – like NABARD for the agricultural sector, or SIDBI for the promotion would be answerable to the RBI and to the finance ministry.

Unfortunately, the government has blissfully forgotten about this report. The finance ministry handles issues related to gold directly. This must change.

#2 Gold must be treated as a financial instrument. Unfortunately, it isn’t. Of course, things were worse before. For decades it was treated as a commodity, hence it came under the purview of the ministry of consumer affairs. Except for few policy announcements like customer duty rates, the finance ministry did not bother itself too much looking at the way in which the gold market developed. Now it comes under the finance ministry, but continues to be treated as a non-financial investment.

#2 Gold must be treated as a financial instrument. Unfortunately, it isn’t. Of course, things were worse before. For decades it was treated as a commodity, hence it came under the purview of the ministry of consumer affairs. Except for few policy announcements like customer duty rates, the finance ministry did not bother itself too much looking at the way in which the gold market developed. Now it comes under the finance ministry, but continues to be treated as a non-financial investment.

One of the immediate implications of gold being regarded as a financial investment is that it comes under the purview of the RBI. It is treated as money. All the customs vaults from which thefts have been reported move under the RBI. Even seized gold gets accounted for.

Once that happens, all gold can be brought under the provisions of FICN (Fake Indian currency notes). The provisions under FICN (Section 489-A- Counterfeiting currency-notes or bank-notes, of the Indian Penal Code allow for life imprisonment and make the act of fraud a non-bailable offense. (http://www.indianlawcases.com/Act-Indian.Penal.Code,1860-1951)

That would do two things. It would make the role of gold refineries that much more important – especially the four first-grade gold refineries identified by the NCDEX after an exhaustive survey and analysis over five years ago. They would become the certifiers of gold quality. They could then adopt the use of specific series of codes through which a jeweller too can be identified (http://www.bis.org.in/cert/hallbiscert.htm). Thus, the FICN rule, the refineries and the BIS would then work in tandem to ensure that gold remains a trusted financial instrument. As confidence is restored, there are good chances that India’s export of gold jewellery will also get a boost. Today, few trust Indian gold jewellery suppliers, for fear of adulteration. Even though hallmarking is compulsory today, the underpinning supporting legal structures don’t exist.

That would do two things. It would make the role of gold refineries that much more important – especially the four first-grade gold refineries identified by the NCDEX after an exhaustive survey and analysis over five years ago. They would become the certifiers of gold quality. They could then adopt the use of specific series of codes through which a jeweller too can be identified (http://www.bis.org.in/cert/hallbiscert.htm). Thus, the FICN rule, the refineries and the BIS would then work in tandem to ensure that gold remains a trusted financial instrument. As confidence is restored, there are good chances that India’s export of gold jewellery will also get a boost. Today, few trust Indian gold jewellery suppliers, for fear of adulteration. Even though hallmarking is compulsory today, the underpinning supporting legal structures don’t exist.

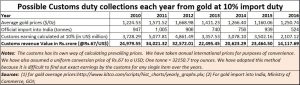

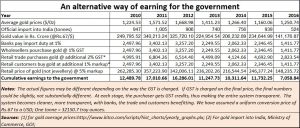

# 3 Reduce import duties on gold. Or, better still, let the duty structure remain for any gold brought in from outside the legal channels. This means that the government (or the proposed BCI) allows gold to be imported by both banks (at least 50% of the volume) and designated gold players. But the import duty for such channeled imports would be just 1% (see table). The banks can sell them to gold wholesellers after charging them a GST of say another 1%. These wholesellers could sell them to the retail trade with an additional GST of 2% (after input credits are applied). The eventual customer would have to pay an additional 1% GST. This way, the entire cost of gold financing would be 5%, thus making smuggling quite unattractive.

True, this would mean that the finance ministry would have to forego at least Rs.7,000-15,000 crore by way of customs duty (see table). But by being greedy about this amount, the government would have to spend almost 10 times more to curb smuggling – of gold, drugs and arms.

What such a system would do is that it would streamline imports yet allow banks earn some additional profits. The scheme could allow for the importing agency to work with approved gold refiners to certify the purity of the imported gold (which can also be adulterated). The cost is around 0.1%. That would put the onus on the importing agencies, the refiners and the wholesellers for ensuring the purity of gold. The enabling provisions of the FICN would ensure that hallmarking is observed scrupulously. It also allows for decent profit margins for gold wholesellers and retailers.

Unless the entire gold trade is viewed in totality, just a piecemeal approach will not work. And without the trade being cleaned up, India has no chance of becoming a gold bourse and a global trading (and exporting) centre for gold jewellery. What remains to be seen is if the government is willing to clean up the system, starting with gold.

COMMENTS