http://www.freepressjournal.in/analysis/rn-bhaskar-government-can-easily-clean-up-gold-market-in-india/1106479

Just three steps and the govt can clean up the gold market

The gold market in India is in a mess. Smuggling continues big time. Seizure of smuggled-in-gold barely accounts for 3% of volumes each year. Corrosion within the vaults owned and managed by the customs department — where gold is stored — is now in evidence. International buyers of Indian jewellery are wary because of the prevalence of gold adulteration in this country (documentation on all the above can be found at http://www.asiaconverge.com/2017/07/duties-taxes-corruption-government-abets-smuggling-gold/). Today, almost 90% of the gold in the markets is adulterated. Surveys in 2006 showed that the adulterated content was around 13%. Today it could be significantly higher.

So, can the situation be remedied.

Yes, if there is political will, and the willingness to take a fresh look at gold markets. That is what Turkey did a few years ago, and quite successfully (http://www.asiaconverge.com/2015/01/turkey-could-teach-india-a-thing-or-two/).

In fact there are three things that the government should do. Immediately.

In fact there are three things that the government should do. Immediately.

First, it is imperative that the government immediately reclassifies gold as a financial investment. True, it comes under the finance ministry today. This was unlike the past when it used to be considered a commodity and came under the ministry of consumer affairs. But it is still treated as a non-financial instrument. Most poor people, even small businesses, use gold as collateral to borrow urgently needed money. The growth of gold loan companies provides evidence of this need. Even SBERBank, the largest bank in Russia – which now has an office in New Delhi — has applied to the government to permit it to enter the gold loan market (http://www.asiaconverge.com/2017/04/making-sberbank-relevant-to-india/).

Making it a financial investment allows for the application of the Indian Penal Code provisions (Section 489-A) relating to FICN (fake Indian currency notes). They allow for life imprisonment and make the act of fraud a non-bailable offense. (http://www.indianlawcases.com/Act-Indian.Penal.Code,1860-1951).

No fresh laws have to be written or passed. There is no need for creating a new legal structure. Just the re-classification of gold as a financial investment should do the trick. That will give teeth to hallmarking, which is now compulsory for all gold jewelers.

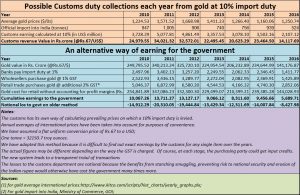

Second, brush the dust off the report the RBI submitted to the government in 2013. Titled Report of the Working Group to Study Issues related to Gold Imports and Gold Loan NBFCs in India,. it was chaired by K.U.B Rao (hence the report is also popularly referred to as the KUB Rao report). It recommended the formation of a separate body for gold,The Bullion Corporation of India (BCI). This entity would look at all aspects of gold, and create proper rules that could ensure both fair play and growth for the industry. Given that Rs.141,000-340,000 crore worth gold is imported each year (see table), the need for a separate professional body is imperative. As the BCI would function under the RBI, all the gold stored in customs vaults – from where theft sometimes takes place – would go to the RBI or get auctioned promptly.

Third, and most important, the government needs to reduce the import duty on gold. Remember, it used to be just Rs.100-250 per 10 grammes earlier. Smuggling – if any — had definitely slowed down then. Unless this is done, smuggling will remain attractive. It will also help build a channel for smuggling in of drugs and arms.

This author recommends the imposition of 1% duty – but only if gold is purchased by banks and designated bodies. Anyone trying to import gold through other channels would be subject to a 10% duty.

These designated bodies then get the imported gold verified by certified gold refineries (because even imported gold can be contaminated). The refineries in turn would then sell to wholesellers. This category could be defined as people willing to buy more than two tonnes a year, with suitable bank guarantees as well. The refiners and wholesellers would be responsible for ensuring that hallmarking (http://www.bis.org.in/cert/hallbiscert.htm) is scrupulously followed by the entire trade. Where there are lapses, the incident would automatically get subjected to FICN related investigations and procedures.

But won’t the 1% import duty and 4% of GST make the government lose some revenue? Yes. But such losses would be notional. In fact, the government could gain a lot more compared to what the customs department may lose. Our estimates show that the government would lose around 10000-15,000 crore (see table) compared to what they collect under the 10% import duty.

Even that is a notional loss. The amount the government could lose if smuggling remains rampant could be a lot more. If duties are not reduced, gold smuggling would also encourage smuggling in of arms which could jeopardize national security. This is because the profits from gold alone will permit smugglers to create a clandestine channel. This channel would identify transporters, routes, landing points, compliant officials and runner boys for gold marketing. Once a channel is set, it is invariably used for smuggling in arms as well.

That is why, gold import duties need to be reduced. Unless that is done, the adverse effects will make the country pay a very high price.

COMMENTS