http://www.firstpost.com/india/pnb-scam-rbis-role-as-banking-watchdog-far-from-impressive-as-swindles-keep-happening-under-its-nose-4359605.html

PNB: Why did the dogs not bark?

For the first time in decades, the entire banking industry is now under scrutiny. The PNB (Punjab National Bank) scam involving Nirav Modi and other diamantaires like Mehul Choksi has thrown a spotlight on the manner in which banks operate.

Almost a decade ago, the focus was on cooperative banks – when the entire board of the Maharashtra State Cooperative Bank (MSCB) had to be dissolved in May 2011. The bank had run into huge losses. Nabard disc9vered the losses first (it put the losses at Rs776 crore — only during 2009-10). MSCB’s total networth had been wiped off and was in the red by another Rs.140 crore (of http://www.asiaconverge.com/2018/01/dont-entrust-fate-banks-government/). NPAs were estimated to be in the region of 30%. Nabard sent its report to the Reserve Bank of India (RBI) which informed the state government, which in turn decided to allow for the board being dissolved. With new government appointed administrators, the bank began making healthy profits within three years.

The RBI has reports on all cooperative banks. But it does not publish them or disclose the losses they have made. One of the rare exceptions was MSCB. Why was that made an exception? Someone has to explain.

The RBI has reports on all cooperative banks. But it does not publish them or disclose the losses they have made. One of the rare exceptions was MSCB. Why was that made an exception? Someone has to explain.

The specious argument given by the RBI is that since these banks are governed by state governments, the RBI cannot disclose the state of finances of such banks. The argument is specious because the money which is swindled by cooperative banks is actually taxpayers’money. The losses banks make have to be made good by taxpayers. The RBI is the central bank, and irrespective of the kind of bank it has to ring the warning bell by giving out timely disclosures. So was the RBI trying to be on the right side of politicians? After all, most cooperative banks are controlled by politicians or by people who are close to politicians.

So was the RBI playing footsie with politicians in the case of PNB as well? One is not very sure whether one can say this that categorically. But there is growing evidence that the RBI did not discharge its functions as sincerely as it had been expected to.

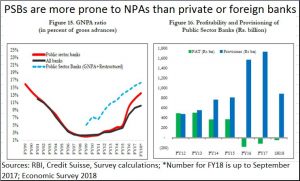

In fact the PNB case is symptomatic of all public sector banks which have taken up a bulk of the non-performing assets. Watch the chart alongside that has been sourced from the latest Economic Survey. The NPAs are likely to be much higher than they were earlier estimated to be. All these NPAs could have been nipped in the bud if someone had alerted the public and all legislators about the malaise to the banking sector. But the auditors of the banks did not put this down in their notes. The RBI too kept quiet till much later, when the rot threatened to sink the boat itself.

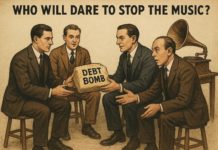

But neither did the RBI nor did the banks’ auditors bark to warn everybody. And there are many reasons why they should have.

First, the RBI could have blown the whistle when it found that moneys were being advanced against Letters of Undertaking (LoUs). Normally, the convention till around a decade ago, was that money could not be lent against LoUs. The central registry did not log such transactions. The dog did not bark.

Second, it did not issue a stern warning when it found that LoUs were being given without providing margin money of 110% of the amount the undertaking was for. Once again the dogs did not bark.

Third, the RBI did not raise an alarm when it found Letters of Credit (LCs) being issued for a maturity period of one year. This was the method adopted by Mehul Choksi, another alleged scamster. Conventionally, since LCs are issued for a maximum period of three months and are a kind of bridge finance till the proceeds of the consignment exported come in. In fact, the central bank should have been more alert about frauds related to diamond imports and exports, because this is a game that has been going on for at least three decades. This author had to move to courts in the mid-nineties to bring a serial promoter of public issues to book on the basis of ECGC reports which confirmed that payment against LCs for diamond exports had not been honoured or ever made. And this was in the mid 1980s. With almost three decades of experience, shouldn’t the RBI have been more alert? Was the dog sleeping?

Fourth, all advances against LoUs by banks (other than PNB) were communicated by highly secure inter-bank messages (using the SWIFT protocol). The RBI had access to all such communications. Clearly, when the communication mentioned that a specified sum was being advanced against an LoU by a bank (other than PNB), the RBI should have asked why advances were being made against LoUs. Had it drilled down the matter further, it would have found that no margin money had been paid either. Had it drilled down even further, it would have discovered that the quantums involved were dangerously large. The central registry had little information. Not surprisingly, the dog did not bark.

Finally, it is the RBI that empanels auditors who can audit bank accounts. Going by media reports, Deloitte was the only auditor which questioned the source of funds that Nirav Modi’s companies enjoyed. The other auditors stayed mum. Yet, none of them has been de-empanelled from the list of auditors who are vetted for auditing bank accounts. The auditors too were also dogs that were supposed to bark. They too did not. Perhaps they too, like RBI, chose to stay quiet because they saw nothing wrong.

And that, as Sherlock Holmes would have said rests the case. The dogs did not bark possibly because they were told that this was regular practice by their masters. The dogs knew the culprits, who were also their masters. At least that is what happened with the Sherlock Holmes story.

It will be interesting to know what prompted the dogs not to bark in the banking story. Were they sick? Or were they trained not to?

COMMENTS