https://www.moneycontrol.com/news/india/comment-cultivating-seaweed-could-be-a-massive-opportunity-for-india-2589455.html

Harvesting seaweed

Asia stands as the world leader in seaweed cultivation and more than 80% is contributed by China, Korea and Japan. India has suddenly discovered that it too can be a player in this market

RN Bhaskar — Jun 13, 2018

A sluggish response to opportunities offered by the sea are the latest example of how India forgets the many blessings it has. We’re talking of growing and harvesting seaweed, a market that’s projected to hit $26 billion globally by 2025.

A recap of the various instances we have forgotten to explore our strategic advantages: First, India is only now waking up to the huge potential that rooftop solar power holds (http://www.moneycontrol.com/news/business/economy/why-its-necessary-to-develop-business-and-transport-along-indias-coastline-2362359.html).

Second, it has still not quite woken up to the strategic advantage of having a huge population and the largest population of cattle, not to mention the huge fields and forests that India has. Together they generate prodigious quantities of waste (both excreta and agro and forest waste) that could be harnessed to the country’s immense financial and environmental advantage (http://www.asiaconverge.com/2018/04/shit-can-mean-big-money/).

Third, India forgot about its 7,500 coastline and did not even have a navy of its own for centuries (http://www.asiaconverge.com/2017/08/necessary-develop-business-transport-along-indias-coastline/). It is making up for lost time only now by focusing on coastal development, coastal economic zones and water transport (http://www.moneycontrol.com/news/business/economy/why-its-necessary-to-develop-business-and-transport-along-indias-coastline-2362359.html).

Back to seaweed. India is just realising another advantage its shores offer – of growing the stuff. And much of the thanks for this is due to a modest, almost by-the-way, enterprise in Tamil Nadu in 2006, and to the then chief minister of Gujarat Narendra Modi, who saw immense strategic advantage in this line of business.

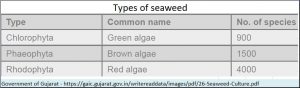

There are about 900 species of green seaweed, 4,000 red species and 1,500 brown species found in nature. Most types of red seaweeds are found in subtropical and tropical waters, while brown seaweeds are often to be located in cooler, temperate waters.

There are about 900 species of green seaweed, 4,000 red species and 1,500 brown species found in nature. Most types of red seaweeds are found in subtropical and tropical waters, while brown seaweeds are often to be located in cooler, temperate waters.

Of these different types of seaweed, around 221 species of seaweed are utilized commercially. Of these, about 145 species are used for food and 110 species for phycocolloid production. “Phycocolloid” is described by the Britannica as algal colloids that can be extracted by hot water. The three major phycocolloids are alginates, agars, and carrageenans. Alginates are extracted primarily from brown seaweeds, and agar and carrageenan are extracted from red seaweeds.

And as has happened with fish farming, industry has discovered the need for seaweed farming as well. It is one way of coping with the inadequate supply of specific forms of seaweed, hence the need to cultivate them through seaweed farming.

Asia stands as the world leader in seaweed cultivation and more than 80% is contributed by China, Korea and Japan. India has suddenly discovered that it too can be a player in this market given its larger and more vibrant coastline.

Why seaweed?

As mentioned earlier, seaweed is now reckoned to be a new renewable source of food, energy, chemicals and medicines. It provides a valuable source of raw material for industries like health food, medicines, pharmaceuticals, textiles, fertilizers and animal feed.

One of the most important uses of seaweed is for the production of agar, alginates & carrageenan. Chemicals from brown seaweeds such as alginic acid, mannitol, laminarin, fucoidin and iodine have been extracted successfully on a commercial basis. As the alginates can absorb many times their own weight of water, have a wide range of viscosity, can readily form gels and are non-toxic, they have countless uses in the manufacture of pharmaceuticals, cosmetic creams, paper and cardboard, and processed foods.

Agar-agar, agarose and carrageenan are commercially valuable substances extracted from red seaweeds and find extensive use in many industries. The greatest use of agar is in association with food preparation and in the pharmaceutical industry as a laxative or as an outer cover of capsules – which earlier used animal cells for making gelatin. With the advent of modern molecular biology and genetic engineering, agar gums producing a variety of products in most laboratories around the world. Carrageenans are generally employed for their physical functions in gelation (include for example, foods such as ice cream), viscous behavior and stabilization.

Seaweed has been a staple food in Japan and China for a very long time. Green seaweed (Enteromorpha, Ulva, Caulerpa and Codium) is used, almost exclusively, as a source of food. These are often eaten as fresh salads or cooked as vegetables along with rice. Some seaweed varieties are used for making fish and meat dishes as well as for soups and accompaniments.

Seaweed is rich in minerals, vitamins, trace elements and bioactive substances. It is hence often referred to as the medical food of the 21st century. Digenea sp. (Rhodophyta) produces an effective vermifuge (kainic acid). Laminaria sp. and Sargassum species have been used in China for the treatment of cancer. Anti-viral compounds from Undaria sp. have been found to inhibit the Herpes simplex virus, and are now sold in capsule form.

Research is now being carried out into using Undaria sp. extract to treat breast cancer and HIV. Another red alga Ptilota sp. produces a protein (a lectin) that preferentially agglutinates human B-type erythrocytes in vitro.

Some calcareous species have been used in bone-replacement therapy. Some are used for controlling and even curing goitre while heparin, a seaweed extract, is used in cardiovascular surgery. Currently there are 42 countries in the world with reports of commercial seaweed activity. China holds first rank in seaweed production, followed by North Korea, South Korea, Japan, Philippines, Chile, Norway, Indonesia, USA and India. These top ten countries contribute about 95% of the world’s commercial seaweed volume. About 90% seaweed production comes from culture based practices.

India enters the picture

India’s advent into this area began quite accidentally with PepsiCo opting to begin seaweed farming in Mandapam (Tamilnadu) in 2006 (http://www.pepsicoindia.co.in/download/print-media/scan0001.pdf) . Its wasn’t long before one of its managers, Abhiram Seth, decided to branch out on his own and set up AquaAgri Processing, by buying out PepsiCo India Holding’s seaweed business in Tamil Nadu.

Mars Chocolate, Pepsi’s client, was interested in the company’s seaweed contract farming. As Seth explained to a media group, “Mars asked us to venture into seaweed cultivation. India has a vast coastline and it did make sense, especially the need to produce carrageenan.” Carrageenan is used as a thickening agent in foods such as chocolates, ice creams, custard powder and pickles.

Mars Chocolate, Pepsi’s client, was interested in the company’s seaweed contract farming. As Seth explained to a media group, “Mars asked us to venture into seaweed cultivation. India has a vast coastline and it did make sense, especially the need to produce carrageenan.” Carrageenan is used as a thickening agent in foods such as chocolates, ice creams, custard powder and pickles.

PepsiCo got involved in seaweed farming because it saw a huge potential for dry seaweed exports. It also began looking at using the seaweed for making liquid fertiliser that is believed to boost crop productivity by around 40%.

That was when the Central Salt and Marine Chemicals Research Institute (CSMCRI) in Bhavnagar, Gujarat, also began looking at the commercial and social potential for this type of farming, and it identified and conducted extensive seaweed cultivation trials in coastal Tamil Nadu for PepsiCo. Today, this seaweed – also known as Kappaphycus alvarezii is grown by the fishing community in Ramanathapuram, Thoothukudi, Pudukottai and Thanjavur districts.

Locations

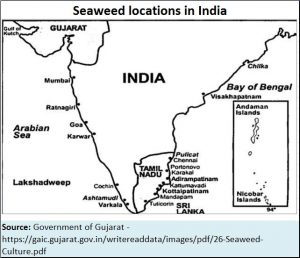

Currently, seaweeds grow abundantly along the Tamil Nadu and Gujarat coasts and around Lakshadweep and Andaman and Nicobar islands. There are also rich seaweed beds around Mumbai, Ratnagiri, Goa, Karwar, Varkala, Vizhinjam and Pulicat inTamil Nadu and Chilka in Orissa. Out of approximately 700 species of marine algae found in both inter-tidal and deep water regions of the Indian coast, nearly 60 species are commercially important. Agar yielding red seaweeds such as Gelidiella acerosa and Gracilaria sp. are collected throughout the year while algin yielding brown algae such as Sargassum and Turbinaria are collected seasonally from August to January on Southern coast.

At present, along with CSMCRI, other research organisations too have pitched in — Central Marine Fisheries Research Institute (CMFRI), Gujarat Livelihood Promotion Company (GLPC) and other institutes too. Seaweed farming fot a fillip in 2012 when the then chief minister, Narendra Modi, decided to prod GLPC to join in in order to fight high malnutrition levels in the State. Small farmers living near the coast were encouraged to take up seaweed cultivation, thus benefiting from not just high value-added incomes but nutrition.

Together they discovered that India had vast seaweed resources along the coastal belts of South India. On the West Coast, especially in the state of Gujarat, abundant seaweed resources are present on the intertidal and sub tidal regions. These resources have great potential for the development of seaweed-based industries in India.

Together they discovered that India had vast seaweed resources along the coastal belts of South India. On the West Coast, especially in the state of Gujarat, abundant seaweed resources are present on the intertidal and sub tidal regions. These resources have great potential for the development of seaweed-based industries in India.

The seaweed industry in India is mainly a cottage industry and is based only on the natural stock of agar-yielding red seaweeds, such as Gelidiella acerosa and Gracilaria edulis, and algin yielding brown seaweeds species such as Sargassum and Tubineria.

Harvesting techniques

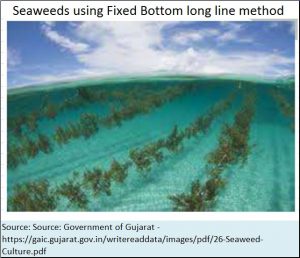

Seaweed is grown in three different ways. One of the most popular in India is using the Single Rope Floating Raft (SRFR) method (Coir Rope & Nylon Rope). This involves building of tethered rafts and spreading them out in the sea. Adequate space must be maintained between the rafts to prevent over-crowding, which in turn affects the quality of the yield. The required sea area is taken on lease from the Tamil Nadu Port Authority, and the planting material was provided by Pepsico. After around 45 days, the seaweed is harvested, dried and carrageenan is extracted from it.

The second method is using a Fixed Bottom Long Line method (Coir Rope & Nylon Rope). And the third is the less used Integrated Multi Trophic Aquaculture (IMTA) method.

The second method is using a Fixed Bottom Long Line method (Coir Rope & Nylon Rope). And the third is the less used Integrated Multi Trophic Aquaculture (IMTA) method.

How profitable is seaweed farming?

This is something that few people provide ready answers to. One reason is to keep profit margins high in this line of business. But going purely by media reports, seaweed cultivators living near the coastline can earn up to ₹2,000 crore a year.

The input costs are almost negligible. Dried seaweed earns up to ₹86,000 per year per raft. A family can create 40 rafts in a year. That could give a family Rs.34 lakh annually!

The input costs are almost negligible. Dried seaweed earns up to ₹86,000 per year per raft. A family can create 40 rafts in a year. That could give a family Rs.34 lakh annually!

Today, some of the big players which have taken up seaweed cultivation are Seth’s company, Tata Chemicals, Coromandel Fertilizers, and Mars Petcare Company, to make pet food. Another entrant that wants to make this a focus area is the Mumbai-headquartered HiMedia, one of the top biological media companies in the world. Its prowess in tissue culture and its ability to use plant cells for tissue culture and developing nutrients has made this industry become an extremely attractive  proposition.

proposition.

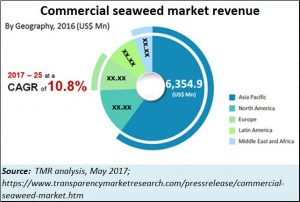

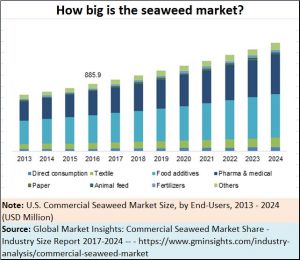

Globally, the size of the seaweed market varies depending on whether one looks at it from an industry point of view or the end use market. According to this source, the global commercial seaweed market is expected to be worth US$26.1 billion by the end of 2025 from US$10.6 billion in 2016. During the forecast years of 2017 and 2025, the global market for commercial seaweed is likely to surge at a CAGR of 10.8%.

Out of the various types of seaweed, the red seaweed is expected to hold a lion’s share in the global market. As of 2016, the red seaweed segment held a share of 52.6% in the overall market in terms of revenue. From a geographic point of view, Asia Pacific is expected to lead the global market in the coming years as it held a share of 60% in the overall market in 2016.

Another estimate puts the number at just $858 million in 2016, but which could double by 2024.

The key players in the global commercial seaweed market include CP Kelco, Seasol International, Chase Organics GB Ltd., Indigrow Ltd., Acadian Seaplants Ltd., Yan Cheng Hairui Food Food Co., Ltd., Algea, Pacific Harvest, Mara Seaweed, Aquatic Chemicals, and others. As mentioned earlier, another key player which has decided to place its flag in the marketplace is the HiMedia group from India. The primary participants in this market invest highly in extensive R&D activities to improve their product portfolio and strengthen their positions in the current market.

According to Wikipedia (https://en.wikipedia.org/wiki/Seaweed_farming) in Japan alone, annual production value of nori amounts to US$2 billion and is one of the world’s most valuable crops produced by aquaculture. “The high demand in seaweed production provides plentiful opportunities and work for the local community. A study conducted by the Philippines showed that plots of approximately one hectare can have a net income from eucheuma farming that was 5 to 6 times that of the minimum average wage of an agriculture worker. In the same study, they also saw an increase in seaweed exports from 675 metric tons (MT) in 1967 to 13,191 MT in 1980, which doubled to 28,000 MT by 1988/”

Clearly, seaweed farming is here to stay. It offers a remedy for non-availability of required quantity of seaweeds for various uses. It is an employment generator, especially for coast based people who might otherwise get marginalised by the development of the coastline. It provides plant based solutions for animal based recipes for the biological, pharmaceutical and food industries, and it allows for uniformity of quality which is crucial for all the user industries. Finally, it is eco-friendly and could become a major tool for coping with coastal pollution in the sea besides reducing carbon emissions that contribute to global warming.

Thanks to the move by PepsiCo and the subsequent push given by Gujarat’s government, India is likely to play a very crucial role in this market.

The author is consulting editor with Moneycontrol.com

COMMENTS