Banker, scamster and the hidden hand –making merry with bank frauds

RN Bhaskar

On 3 August, 2018, the government made a disclosure to the Lok Sabha which should make many people sit up and shudder.

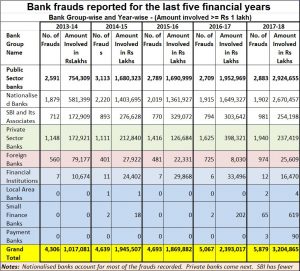

The government pointed out that in 2017-18 alone, there were 5,897 instances of bank-fraud that had come to light and were being investigated. Collectively, they involved a sum of Rs.32,048.65 crore. If that was bad enough, a further perusal of the figures showed that this number was higher than the discovery of 5,067 instances of bank fraud during the previous year. Collectively they involved a sum of Rs.29,930.17 crore. Clearly, the numbers were increasing – both in terms of instances of fraud, as well as the sums involved.

The government pointed out that in 2017-18 alone, there were 5,897 instances of bank-fraud that had come to light and were being investigated. Collectively, they involved a sum of Rs.32,048.65 crore. If that was bad enough, a further perusal of the figures showed that this number was higher than the discovery of 5,067 instances of bank fraud during the previous year. Collectively they involved a sum of Rs.29,930.17 crore. Clearly, the numbers were increasing – both in terms of instances of fraud, as well as the sums involved.

PSBs as honey-pots

What muddies the waters further is that the largest numbers of frauds took place with nationalised banks, followed by private banks and then with SBI.

Even though the number of instances of fraud at SBI was smaller than that for private banks, the amounts involved were certainly larger.

The numbers confirm that Indian banks have a poorer track record when it comes to protecting money that depositors keep with banks. The numbers also highlight how the role that nationalised banks were meant to play in India is quite different from what actually takes place. Over the decades, public sector banks (PSBs) have actually become honey-pots, which continue to attract scamsters in collusion with the powerful. Eventually, it is the tax-paying public that has to pay for the illegal amassing of wealth by both the powerful and the sly.

Look at all the scams that have taken place in the past. In each scam there is the scamster who is investigated, pilloried by the media. But quite often, conveniently overlooked by people, is the role of the bank and that of an invisible person who instructs – or allows – the banker to give away money to the specific scamster. A good example is the way Vijay Mallya was denied an extra line of credit. Overnight banks did an about turn and allowed him loans against a brand value – something that is seldom done by bankers. Somebody had asked the bankers to become inventive – in much the same way as investment bankers – and forget the rules of prudential banking.

The banker could involve a nationalised bank – which is usually the case. Sometimes the RBI or a financial institution (like the LIC or the UTI) is also involved – like it was in the Haridas Mundhra and the Harshad Mehta Scams (http://www.asiaconverge.com/2018/08/india-passes-the-promotion-of-corruption-act/). At times it is the RBI as well, which chooses to look away – as it did when bogus SGLs were being submitted by Harshad Mehta, or fake LOUs were being issued by Nirav Modi and his ilk (http://www.asiaconverge.com/2017/09/off-the-book-epayments-have-the-potential-of-big-scams/). The absence of a centralised database recording all such advances and the instruments used was never implemented. It was this loophole – of not having a centralised ledger – that allowed the Jignesh Shah-NSEL scam to take place (http://www.asiaconverge.com/2017/09/off-the-book-epayments-have-the-potential-of-big-scams/).

Unholy trio

It is this unholy nexus of banker, scamster and the hidden hand which can always be found behind almost every major scam.

One of the best examples of the three being involved was quite evident in the Haridas Mundhra Scam where Jawaharlal Nehru and/or the finance minister – through the finance secretary – illegally instructed the LIC to advance money to Mundhra against his shares (many of which were later found to be bogus).

At other times, the invisible hand points directly to the prime minister. This is what happened during the infamous Rustom Sohrab Nagarwala case of 1971 (https://en.wikipedia.org/wiki/1971_Nagarwala_scandal). He – according to available reports — impersonated the voice of a key person from the office of the then prime minister Indira Gandhi and asked the SBI manager to hand over trunks of currency notes into a waiting car. The manager, who was (evidently) used to such calls, agreed to this plan, and got his people to park the cash boxes into the waiting car which then disappeared. It was only much later that the bank realised that it had been duped. The police swung into action.

But before they could apprehend Nagarwala, he announced to an agog media that he was responsible and that he wanted to show how easy it was for the powerful to take money away from the banks. He was arrested, and he died in police custody – which led to further questions. The death of the case handlers only added to the mystery. The investigation report was never fully closed, or concluded.

And yet, in spite of these clear indications that the scamster is always backed by someone powerful and later by a powerful person in the government. After the Mundhra scam, the government first protected the bureaucrat from being investigated without permission from ‘competent’ quarters. It then went on to extend this protection to politicians. On July 23, 2018, the government extended this protection to bankers as well (https://www.moneycontrol.com/news/india/opinion-why-corrupt-politicians-and-bureaucrats-can-now-breathe-easy-2822671.html). Now all the three – the scamster, banker and the hidden hand enjoy protection.

The evidence that the government placed before the Lok Sabha on 3 August 2018, highlights how dangerous the July 2018 amendments to the Prevention of Corruption Act could be, and how the incidence of fraud at banks could increase even further.

The government in its reply before the Lok Sabha stated that the “Reserve Bank of India( RBI) has constituted a Committee under the chairmanship of Shri Y H Malegam on February 20, 2018, to, inter-alia, look into factors leading to an increasing incidence of frauds in banks and the measures (including IT interventions) needed to curb and prevent it; and the role and effectiveness of various types of audits conducted in banks in mitigating the incidence of such divergence and frauds.”

Vigilance and investigation? Really?

The government also stated that the “Central Vigilance Commission, CVC has analysed 17 large value accounts, belonging to seven different sectors namely Gem & Jewellery, manufacturing/Industry, Agro, Media, Aviation, Service/Projects and Discounting of Cheques. It stated that PSBs have been advised to put in place suitable safeguards to protect their organisation’s interests while transacting with these sectors.

It also provided to the Lok Sabha bank group-wise details of frauds reported during the last five financial years as provided by the RBI. It also stated that the Central Bureau of Investigation (CBI) has informed that they are investigating 292 bank cheating/ fraud etc. scam cases as on 27.03.2018.

It is worth noting that the investigation relates to just 298 out of 5,879 incidents during that year, and without including the instances of bank-fraud in earlier years). .

The government reminded the Lok Sabha members that — in May, 2015 — it had issued instructions to all the CMDs/MD & CEOs of PSBs on “Framework for timely detection, reporting, investigation etc. relating to large value bank frauds”, which, inter-alia provides that all accounts exceeding Rs. 50 crore, if classified as Non-Performing Assets, should be examined by banks from the angle of possible fraud. A report would be placed before the Bank’s Committee for review of NPAs on the findings of this investigation. The above instructions have been reiterated in February, 2018. Once again, it is worth noting that despite this notification to the RBI, the incidence of frauds did not decline.

The government added that the RBI has issued “Master Directions on Frauds-Classification and Reporting by commercial banks and select FIs” which provides a framework to banks enabling them to detect and report frauds early and taking timely consequent actions like reporting to the Investigative agencies so that fraudsters are brought to book early, examining staff accountability and effective fraud risk management. The CVC manual also provides that in the case of accounts categorized as NPAs, banks must initiate and complete a staff accountability exercise within six months from the date of classification as a NPA. The completion of the staff accountability exercise for frauds and the action taken may be placed before the Special Committee of the Board for monitoring and follow-up of Frauds (SCBF).

The government stated that investigating agencies have now been permitted to take the help of professionals including banking and tax experts while conducting inquiry. And that the Prevention of Corruption Act, 1988 has recently been amended and Prevention of Corruption (Amendment) Act, 2018 has come into force on 26th July, 2018.

The last remark was obviously the best laugh. An uproarious one, indeed!

COMMENTS