https://www.moneycontrol.com/news/business/companies/opinion-please-leave-msme-interest-rates-alone-3207301.html

It is both stupid and dangerous to tinker with MSME interest rates

Banks are already weakened by bad loans. Concessional interest rates and forcing them to increase their allocation of funds to MSMEs from the existing 20-25 percent is not a wise way of strengthening the banking sector

RN Bhaskar — 22 November 2018

Some people are ecstatic about Prime Minister Modi announcing a package for micro, small and medium enterprises (MSME) in India. The prime minister has promised them loan clearances in 59 minutes flat and disbursals within ten days. He even promised them concessional interest rates on borrowings. It was a great idea. But it is a flawed deci sion.

sion.

First, the caveats. There is no denying that MSMRs are the backbone of the Indian economy. They employ over 90% of the organised sector work force and account for over 90% of the total number of units.

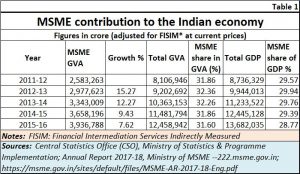

Just look at the numbers. The annual report for MSMEs for 2017-18 (Annual Report 2017-18, Ministry of MSME — www.msme.gov.in — https://msme.gov.in/sites/default/files/MSME-AR-2017-18-Eng.pdf) points out that this sector accounted for Rs.39 lakh crore of gross value added (GVA) and Rs.138 lakh crore of GDP. That meant that the MSMEs accounted for most 31.6% of the country’s GVA and 28.8% of GDP.

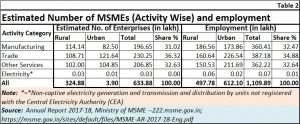

Then look at the employment numbers as well. The 6.33 crore enterprises accounted for 11 crore jobs of which 5 crore were in rural areas. Obviously, MSMEs cater to a crucial sector of votes, especially in states like Uttar Pradesh which accounts for 14% of all MSMEs.

Then look at the employment numbers as well. The 6.33 crore enterprises accounted for 11 crore jobs of which 5 crore were in rural areas. Obviously, MSMEs cater to a crucial sector of votes, especially in states like Uttar Pradesh which accounts for 14% of all MSMEs.

The only dark cloud is that the rate at which they have been growing has been declining. They grew by 15% in 2012-13 over 2011-12; the following year they grew by 12.3%, then by 12.3% again, and in 2015-16 they grew by only 7.62%. Clearly, they needed incentives, and needed a bit of prodding to accelerate their rate of growth. Demonetisation had hit them very hard, and so has GST. The latter has increased their need for working capital, because GST must be paid at the time of invoicing, even before the money comes into the kitty.

But there is no denying that many MSMEs have been weighing down the list of non-performing assets (NPAs) in India They have become riskier to lend money to. Worse, the risk is growing each month. And that is why the idea of giving them loans at subsidised rates of interest is a terribly bad idea.

People often forget that the interest rate is a reflection of the risk that the borrower poses. The riskier the borrower becomes (either because of the industry, or the markets, or because of a personal downturn in fortunes) the more will the interest rate climb. This is the market’s way to ensure that money is used carefully, and all prudential lending is based on this principle. Violate this norm, and you will end up creating a mess in the financial sector.

Just go back to the times before the 1990s when long-term lending carried a lower interest rated and short-term lending a higher interest charges. Any college student would have told you that this was insane. Long-term borrowing poses more risks than short-term lending. I can predict that I will go somewhere tomorrow – most appointments are fixed on this assumption of predictability. But I cannot say for certain that I will meet an appointment fixed for a particular day five years hence.

The result of this interest rates structure in the pre-1990 era was that businessmen often borrowed for long-term projects and then diverted the mo0ney for short-term use. Banking was turned on its head. This was rampant, and hurt banks terribly. Mercifully this practice was ended.

Risk is the reason why, with other things being equal, long-term borrowing always carries a higher rate of interest than short-term. That is also why riskier loans command higher interest rates than less riskier loans. That is why interest rates for MSMEs should be determined by the risk they pose to the lender.

The trouble with interest concessions is that many businesses will spawn MSMEs, borrow money against them, and divert the money to non-MSME uses. It will be difficult for banks to monitor end-use because the numbers of MSMEs are huge. And the constraints of bankers are many. Result, such practices could lead to major problems for the banks and for the rest of the economy.

So how does one help out MSMEs?

Two ways: First, give them a tax break. Reduction of GST rates would be one good way. True, the government did toy with this idea in August 2018 (https://www.financialexpress.com/economy/msme-sector-gst-council-to-take-up-further-relief/1258664/), but gave it up because nobody could decide on the amount that should be borne by the state governments and how much by the centre.

But that was an academic issue. Eventually, this is paid for by common taxpayers like you and me. But there is one difference. Since GST is paid on the basis of production of goods and services, there can be no diversion of funds. Lower interest charges actually encourage people to cheat. Hence the reduced GST pinches taxpayers less severely than concessional interest rates.

A second way would be to encourage MSMEs to go in for credit rating. This way, they learn how to reduce their risk profile. They become eligible for lower interest rates – not as a favour from the government but because they deserve it.

Together, both reduce the financial burden on MSMEs and contribute to the health of the economy.

The banks are already weakened by the NPAs. Concessional interest rates, and forcing them to increase their allocation of funds to MSMEs from the existing 20%^to 25% is not a wise way of strengthening the banking sector.

COMMENTS