https://www.freepressjournal.in/cmcm/the-way-ahead-for-economic-growth-and-jobs

The priority should be economic growth and jobs

RN Bhaskar — 13 June 2019

The Indian economy is at the brink of extremely difficult times. At such times, a report from the CII (Confederation of Indian Industry) titled Investment Requirements in India Roadmap for 2019/20 – 2023/24, does make for very interesting reading.

But let’s start with the signs of distress:

First, the major financial difficulties. A slipping Index of Industrial Production (IIP) is a major headache. If more jobs are to be created, this index needs to go up (http://www.asiaconverge.com/2019/05/even-the-iip-suggests-that-india-has-a-painful-six-months-ahead-unless-it-is-only-when-one-goes-to-the-components-that-ma/).

First, the major financial difficulties. A slipping Index of Industrial Production (IIP) is a major headache. If more jobs are to be created, this index needs to go up (http://www.asiaconverge.com/2019/05/even-the-iip-suggests-that-india-has-a-painful-six-months-ahead-unless-it-is-only-when-one-goes-to-the-components-that-ma/).

An economic slowdown is much in evidence (http://www.asiaconverge.com/2019/01/india-must-brace-itself-for-an-economic-slowdown/).

FDI (foreign direct investment) hasn’t picked up (http://www.asiaconverge.com/2019/05/effective-dispute-resolution-needed-for-increase-in-fd/). The bank NPA problem continues to fester (http://www.asiaconverge.com/2019/01/lessons-learnt-npa-recovery/).

The financial contamination could be greater. But the RBI, IRDAI and SEBI have opted to conceal the rot. They have refused to compel insurance companies to disclose the erosion of their assets. The collapse in valuations following the Essel Group and IL&FS debacles thus remains unclear (http://www.asiaconverge.com/2019/04/make-mandatory-investment-disclosure-by-insurance-companies/).

Then there are the unpaid bills of the previous government which could be over Rs.12.4 lakh crore (http://www.asiaconverge.com/2019/05/new-government-will-inherit-unpaid-infrastructure-bill-of-rs-12-4-lakh-crore/). Add to this the populist schemes that must be paid for (http://www.asiaconverge.com/2019/04/doles-freebies-will-result-in-corruption/). This includes discom losses as well.

India obviously needs a revival package urgently. For this it needs two things – investments and jobs. Without investments, jobs will not get created. And without jobs, translated into purchasing power, consumption will not take place. With rising trade barriers ruling out any significant export growth, the focus will have to be on reducing imports and increasing consumption.

The CII paper does not address such needs.

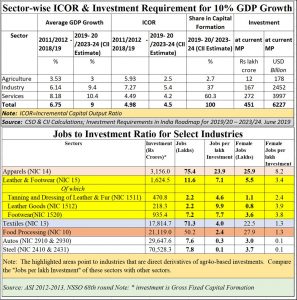

The CII document states that India will need investments worth Rs.451 lakh crore at current prices. This amount is roughly twice the figure of Rs. 226.8 lakh crore during the previous 5 years – assuming the level of the Incremental Capital Output Ratio (ICOR) to average 4.5 over this period. Thus if the current government has to increase India\s GDP growth rate to 10% per annum, these additional investments will be urgently required.

There is nothing wrong about the investment assumptions. What could be questioned is the way CII expects these investments to be allocated.

The CII expects 2.7% of this ICOR to be invested in agriculture, 37% in industry, and 60% in services. This author believes that the allocation to agriculture is too small.

Look at the second part of the table given alongside. Look at the number of jobs that can be created per lakh rupees of investment. Clearly, the biggest bang for the buck would come from agro-based industries – be they leather, or textiles/apparel or milk or food processing.

Agriculture accounts for almost 50% of the population. India’s consumption demand depends on this sector having additional purchasing power. That can come only if agriculture earns more through value-addition.

Today the farmer gets barely 10% of the market price for his produce. Doubling this to 20% will not help. He must get at least 50% of the market price – that is what the late Verghese Kurien also believed (http://www.asiaconverge.com/2018/12/empower-farmers-through-the-kurien-or-wdra-models/). This can come through increase in prices of farm produce, or making the farmer go in for value addition. That will help create more jobs, more consumption and more industrial and services output.

There are three recommendations of the CII recommendations, however, that are definitely worth noting

- Within the Industrial sector, Mining & quarrying, Manufacturing, Electricity, gas & water supply, and Construction would require an investment of Rs 8 lakh crore, Rs.90 lakh crore, Rs 42 lakh crore, and Rs 27 lakh crore, respectively, over the next 5 years.

- A significant push to investment in infrastructure would be crucial for accelerating the growth momentum of the entire economy. CII believes that the infrastructure to GDP ratio must move up from the current level of around 6% to an average of at least 8% over the next 5 year. This would translate into an infrastructure spending of around Rs 89 lakh crore (US$ 1.3 trillion) over the next 5 years.

- In the current milieu of sluggish investment scenario, the public sector should continue spending a larger share than the private sector on infrastructure. At least 55% of the investment in infrastructure should be undertaken by the public sector.

The CII report does not make any mention about the need to reduce India’s Balance of Payments (BoP) by promoting industries that reduce imports – like affordable housing (http://www.asiaconverge.com/2018/04/smiles-sorrows-world-bank-forecasts-india-gdp-rise-raises-unemployment-concerns/), rooftop solar (http://www.asiaconverge.com/2019/03/no-clear-focus-on-rooftop-solar/) and waste to energy (http://www.asiaconverge.com/2019/03/trade-crisis-looms-india-sun-waste-can-prevent/). Nor does it talk about the need to revamp the country’s water policies – a crucial need.

But, overall, the focus on the funds needed is a good starting point. The CII needs to be commended for that.

COMMENTS