https://www.freepressjournal.in/editorspick/introduce-the-cash-for-clunkers-policy-soon

Revive the economy with speedy judicial redressal and a scrapped vehicle policy

RN Bhaskar – 5 September, 2019

Last fortnight, finance minister Nirmala Sitharaman announced a slew of measures that she thought would galvanise the economy. Among them was a roll-back of taxes for the foreign portfolio investors, easing rules for foreign direct investment (FDI), a reversal of other levies, and significant benefits for the automobile sector (https://www.freepressjournal.in/editorspick/stimulus-in-small-doses-could-be-a-way).

This author believes that the sops announced won’t go too far because of several reasons.

First, almost every foreign direct investor is waiting for a government assurance that arbitration awards by tribunals will not be reopened by Indian courts. Arbitration becomes meaningless if courts are allowed to prolong dispute resolution. That is why, even the Supreme Court ruled that awards by tribunals seated outside India cannot be reopened by India courts (http://www.asiaconverge.com/2016/08/arbitration-awards-india-shaken/)

Second, investors want assurances that their investments will be protected, and that the tax regime will not witness capricious changes, as was witnessed in the last budget.

Third, consumers of vehicles are still waiting for the additional sop which will allow them to surrender their old vehicles and get new ones.

Some of the sops for the auto mobile sector were:

– BS-IV vehicles purchased up to March 2020 will remain operational for the entire period of registration.

– Both electric vehicles (EVs) and Internal Combustion Vehicles (ICV) will continue to be registered.

– The government will lift the ban on government departments for purchasing new vehicles for replacing old ones.

– Allow an additional 15 % depreciation on new vehicles acquired till March 2020.

– Levy of (higher) one-time registration fees deferred till June 2020.

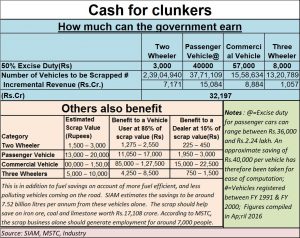

But these are inadequate. This author has maintained that it is time that the finance ministry immediately clears the proposal submitted to it in the first quarter of 2016. That proposal would encourage people to turn in their old vehicles and get a 50% rebate in taxes and levies on vehicles – which are substantial (http://www.asiaconverge.com/2016/04/new-vehicles-for-old/).

But these are inadequate. This author has maintained that it is time that the finance ministry immediately clears the proposal submitted to it in the first quarter of 2016. That proposal would encourage people to turn in their old vehicles and get a 50% rebate in taxes and levies on vehicles – which are substantial (http://www.asiaconverge.com/2016/04/new-vehicles-for-old/).

A table that these columns sported in 2016 is relevant even today (see chart).

The finance ministry stated last fortnight that it was still looking at this proposal, but that the modalities had to be worked out. That is worrisome. The ministry had three years to study the proposal. It has been talked about, mulled over, and then left on the shelves to gather dust. It speaks volumes of how the finance ministry is reluctant to accept the simplest of ideas that can galvanise sales and even move old vehicles off the road. It points to a dog-in-the-manger approach, where the finance ministry is content with losing the money it gains from the automobile sector (http://www.asiaconverge.com/2019/08/auto-secforand-economic-revival/). But it reluctant to announce a policy that puts actual cash back into the pockets of consumers.

Consider the following:

All that the finance minister must do is to allow automobile manufacturers collect the old vehicles and sell them to steel mills. A new collection system is unnecessary. Automobile companies have linkages with steel mills (as it is a key raw material). They have a vested interest in boosting their sales. They already have access to potential customers. Allow them to collect the vehicles – they can also decide on any additional discounts that potential customers could get – for selling their old vehicles. The automobile companies could then sell the scrapped vehicles to steel mills and accept their certification to allow a 50% rebate on government levies for new vehicles produced.

To further sweeten the process, allow auto companies to keep the money from scrapped vehicles sold to steel mills as their additional earnings. It would boost the profit margins of auto companies. That would translate into higher income tax and GST collections by the government. It would make steel mills profitable too. That too would benefit the government with the contribution of additional taxes and levies. And it would make customers happy because they get good discounts for trading in their old vehicles and taking new ones back home.

At the same time, such a proposal would allow old vehicles to move off the roads, and de-choke them. It would give steel mills precious raw material without resorting to imports, and it would give automobile manufacturers the ability to sell more vehicles. Such a policy could drive more sales that mere concessions like allowing sales to continue or delaying the increase in vehicle registration charges.

In turn the government gets 50% of the revenue instead of near-zero revenues.

But this is only the starting point. Begin laying the groundwork for policies that allow for the transition of automobile vehicles towards electric vehicles or hydrogen driven cars. The disruption is inevitable (https://www.youtube.com/watch?v=2b3ttqYDwF0). Put in place a mechanism for charging vehicles that is both robust and benefits everyone.

But more on that next time.

COMMENTS