https://www.freepressjournal.in/analysis/urgent-need-for-gold-reforms

Gold reforms are being delayed. Why?

RN Bhaskar — 14 November, 2019

Last week, on Nov 5, 2019, this publication, in association with BSE (Bombay Stock Exchange) held a conference on The increasing allure of gold.

As discussions continued, each panellist spoke of the huge potential gold has in India, and how the government itself has stymied this opportunity. It was coincidental that just two days after the conference, former RBI governor, YV Reddy chose to write an article on Gold in which he bemoaned that “India’s policy making has been less than sensitive” to the ethos and the economy when it comes to gold

As discussions continued, each panellist spoke of the huge potential gold has in India, and how the government itself has stymied this opportunity. It was coincidental that just two days after the conference, former RBI governor, YV Reddy chose to write an article on Gold in which he bemoaned that “India’s policy making has been less than sensitive” to the ethos and the economy when it comes to gold

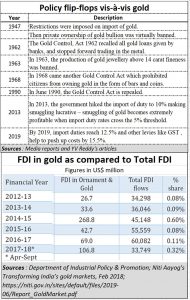

He pointed out the various policy flip-flops on the part of successive governments. But a cursory glance at the past shows how capricious governments have been (see chart).

The irony was that just over a year ago, in February 2018, the government’s Niti Aayog had come out with a report titled Transforming India’s gold markets, (https://niti.gov.in/sites/default/files/2019-06/Report_GoldMarket.pdf). In its report, all the hurdles that the gold trade experienced in India was sought to be removed within six months to a couple of years. The entire trade was certain that a new gold policy would be out in the next budget. None of that happened.

As a result, FDI in the gold industry has remained pathetic, almost embarrassingly so. Smuggling has become rampant, thanks to the huge import duty, and the corrosion of the rupee continues because of the clandestine demand for dollars to finance gold smuggling (http://www.asiaconverge.com/2019/10/india-gold-policies-make-the-country-poorer/). The trade limps along. And as pointed out rightly by the Niti Aayog document, the focus should not be on gold imports but creating the environment for catalysing gold exports. Once that is looked at seriously, the CAD ceases to matter.

As the Niti Aayog document puts it” “Gold impacts the Indian economy in multiple ways. The first impact is on the scale of economic activity in the economy. Gold is used as a raw material for jewellery fabrication and making coins. This in turn creates business opportunities, value addition and employment. A study by A.T. Kearney with reference to the year 2012-13 mentions that value addition in the sector is to the tune of 25 percent of the value of gold imported into the country1. This includes value addition in jewellery manufacturing, retailing and exports and metals trading. In addition, the industry value-chain has a potential capacity for refining and mining, which can further generate jobs in the rural areas. The second way, which is the conventional way of looking at gold, is the impact of gold imports on trade balance and current account in the Balance of Payments (BoP).”

The document also admits that according to the estimates it has received for FY 2016 -17, the gems and jewellery industry of India is approximately INR 6.5 trillion in size. Almost 90% of the units belong to the MSME category. It has grown at a CAGR of 14.5% over the past 50 years. As of January 2017, the industry employs around 6.1 million skilled and semi-skilled workers across India, apart from the numerous entrepreneurs that it houses, and is expected to provide employment opportunities to more than 9.4 million persons by 2022.”

Look again at the figures above. Anyone can see that these are figures that talk of the potential of Make in India, employment generation and galvanising exports. So is India looking a gift horse in the mouth?

This is evident in the five focus areas identified by Niti Aayog:

- Make in India in Gold

- Financialization of Gold

- Tax and Duty Structure

- Regulatory Infrastructure

- Skill Development & Technology Upgradation

The report admits that the gold industry has multiple regulators and ministries working in silos regulating a single product that result in policies that hinder the growth of the industry. There is need to foster an ecosystem that provides a single-window, one-stop interface for the industry that will encourage standardisation, transparency and accountability, which will generate focused efforts that are comprehensive and inclusive.

That is why the report advocate the immediate setting up of a “Gold Board of India” (GBI) which should be an advisory body under the Ministry of Finance. Gold as a foreign exchange asset would continue to be professionally managed by RBI. The other three offices that are needed to be set up are those of a gold regulator, a gold spot exchange and a bullion bank. The bullion bank and a gold spot exchange would focus on “price discovery and hence, provides the entire ecosystem around physical deliveries.” Together, all of them “cover the spectrum of changes required in the gold policy for Transforming the Gold Market.”

That was in February 2018. Has the government gone to sleep over this report?

COMMENTS