MARKET PERSPECTIVE by Jawahir Mulraj

Is the Production Linked Incentive Scheme enough?

By J Mulraj — Nov 8-14, 2020

The Government gave a push to the manufacturing sector by announcing a Production Linked Incentive (PLI) scheme, giving a monetary incentive in ten identified sectors, with an outlay of Rs 1.46 lac crores (about $ 10.5 b). This is a further effort to boost self reliance, or Atmanirbharta, and to attract more companies seeking to shift production bases out of China, to consider India as a destination.

India has lots of advantages, for sure, for foreigners to consider it as a manufacturing destination. It also has roadblocks, which need to be addressed seriously, but are taking time to.

PM Narendra Modi addressed, via webcam, large global funds, which together manage some $ 6 trillion of assets, to pitch India to them. This is necessary. The total pool of global money invested in financial assets is $ 378 trillion, hence addressing managers of a $ 6 trillion pool is one of a series of steps. There are many other steps needed, as pointed out by senior journalist R N Bhaskar.

As a multi party democracy, with a need to take several stakeholders on board, our pace of implementation leaves a lot to be desired. This is not the best endorsement for attracting FDI. Large and nationally important projects, such as the Dedicated Freight Corridor, a $ 11 b. project to create 6 rail corridors only for freight trains, and funded by Japan on easy terms, is slow. So are other projects like DMIC (Delhi Mumbai Industrial Corridor) or the Mumbai-Pune bullet train project.

This absence of maintaining and sticking to a timeline is most visible in the judiciary, which has built up a huge backlog of cases. This is another deterrence to attracting more FDI. It ought to be easy to pass orders, in consultation with the judiciary, limiting the number of permissible adjournment requests to 1 or 2 per side, as is internationally practised.

Perhaps the reason for the unwillingness to do this is that the law makers are often the law breakers. Shockingly, 68% of newly elected legislators in Bihar have got pending criminal cases against them, including serious ones like murder or kidnapping. So long as the cases are pending, they are free to stand for elections, an incentive to permit innumerable adjournments.

So, one of the steps needed is electoral reforms, by which the quality of the polity would improve. If the polity is unwilling to do this, the voters must! They should simply refuse to vote for any candidate that has pending criminal cases; if all of them have such cases, to simply vote NOTA (None of the above).

Besides faster speed of execution of projects, and faster judicial remedy, especially of contractual obligations, India also needs to have an alternative system of dispute resolution in order to attract FDI. The enforcement of awards of international arbitration, is needed, and this is ensured by Bilateral Investment Treaties (BITs). Also, it is necessary to avoid changing laws retrospectively, one of the biggest setbacks to attracting more FDI.

India needs to attract FDI for several reasons; to bring in new technologies and to provide more jobs. The Fourth Industrial Revolution is upon us. The first industrial revolution used the steam engine to increase production. The second used science and mass production. The third used digital technology. Each of these was followed by a rise in productivity and economic growth.

The 4th Industrial revolution will use new technologies for the same purpose. These include technologies like 5G, Internet of Things (IoT), Artificial Intelligence (AI), Robotics, 3D printing, Quantum Computing and the like. India has made some progress towards these (e.g. Reliance Jio is developing its own 5G technologies and has brought in global leaders as partners) but we still need to do more. An environment that encourages and facilitates FDI would be needed. Remember, some of these technologies like Robotics and IoT will result in job losses; so there is an urgent need to attract FDI, and an opportunity to do so when anti China sentiment is prevalent.

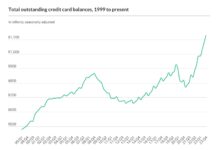

The finances of State Governments has been badly affected but fall in revenue collections, especially in GST, and compelling them to cut capital spending by $ 36 b. Hence the need for the Centre to chip in to attract more FDI.

Last week the BSE sensex gained 3.7% to end at a new high of 43,443.

The border tensions with China seem likely to ease after Commander level talks. India has done well in several areas of defence manufacture, to increase its self reliance. Recently signed agreements with the US will allow for inter operability in communication. This is a determining factor in modern warfare, viz. the ability of machines to communicate with each other in scenarios where split second decisions are being made. One hopes that the change in Presidency in USA will not affect these agreements.

Perhaps if this inter-operability in communications is achieved in the political realm as well, the India story would become unbeatable! There is a huge scope for both FDI and FII investment to come to India. But we need to work on areas of perceived weakness to make it happen.

COMMENTS