By J Mulraj

2020 was NOT perfect vision

By J Mulraj — Dec 20-26, 2020

The world would be happy to say goodbye (adieu) to a horrible year, rather than au revoir (till we meet again).

The Covid pandemic, the first case of which was detected in December 2019, has wreaked havoc in both lives and livelihoods across the world, the after effects of which are still being felt. The creation, in record time, of several vaccines to fight it, and the approval of some, for public distribution, lends hope that it can arrest the spread, and, in so doing, can lead to the opening up of economies to restore jobs and growth.

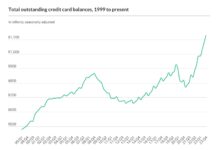

Investors have been happy because stock markets are at record highs, thanks mainly to the flood of liquidity released by Central Banks to aid citizens whose jobs or businesses have been hit by Covid. After the 2008 global financial crisis, too, there was a sharp recovery attributed to a similar flood of liquidity. The difference between 2008 and 2020 is that the Dow Jones Industrial index had then bottomed out in March 2009, at 6,547 once the crisis was seen to be over, and has risen to 30,199 on Christmas eve, 2020, a new high. But in 2020, it bottomed out on March 11, immediately after a sharp fall, at 23,553, gaining by the experience of the effects of globally induced liquidity on markets. Remember, lock downs had just commenced in March and everyone knew that most sectors of the economy would be badly hit.

The BSE sensex ended the week at 46,973, a record high, up 13 points over the previous week. It, too, had bottomed out in March.

Here are some of the things investors should keep an eye on:

America versus China battle for hegemony: In 2019 President Trump foresaw the threat of China to its global preponderance. China had amassed enormous financial wealth after acceptance in WTO, whose rules it did not always follow, and had used it to build up dominant manufacturing capacities in core sectors like steel (it produces 53% of global steel) and cement (60%) and rare earths (over 90%) used for electrical and electronic industries, and in defence. China has also developed skills in technologies for the 4th Industrial Revolution including 5G telephony, robotics, Internet of Things, Artificial Intelligence, and others.

China has also built a formidable defence capability,(initially by copying) and uses this to take a belligerent posture against almost all countries, including India, whose rise as a regional power it wants to supress.

President Trump has demonstrated his willingness and ability to challenge China, and one has to see how a President Biden will. Trump has yet not accepted the elections, and is the challenge it on Jan 6, 2021, when the Congress meets to decide. The process involves getting each state’s legislators (there are two in every state) to certify who won the electoral votes in that state (winner take all) and then to announce the winner as the one who got over 270 votes. Trump is attempting to get enough of the swing States to de-certify the results to cause Biden’s votes to drop from 306 to 269 (below 270). Should that happen, Trump is trying to get a special session of Congress to vote on the next president in which, as per Amendment 12, each state gets one vote, instead of each member.

There is a possibility of civic unrest, whoever is elected the next President.

Meanwhile China also has its own set of problems. A food shortage caused by floods destroying produce (it has had to import rice, soya and other items). A coal shortage, after it banned Australian coal as retaliation for Australian demand of an inquiry into the origins of Covid, as a result of which there is an electricity shortage in some provinces, in the middle of winter. Several Government companies have defaulted on bond payments, suggesting financial strain, compounded by high debt of Local Governments on top of national debt.

All this heralds a continuation of trade tensions and impacts global trade. It was thanks to globalisation that millions of people were lifted out of poverty and that trend is sharply reducing.

What individual investors can learn from farm protest in India: The individual investor in India is just a guinea pig and has no protection. Bank deposits pay less than inflation, and are a slow erosion of savings. Besides, lending by banks often results in non-repayment or servicing, and bad debts. Ultimately, as in PMC bank, it is the depositors who suffer. Punishment for white collar crime is rare and this encourages more.

The latest is a Hyderabad based Agri Gold scheme which duped individual investors of Rs 6,400 for personal gain. The Enforcement Directorate (ED) has seized assets of Rs 4,100 crores. What use is this to the victims?

To illustrate, in the NSEL case, the ED had similarly seized assets and, despite having sold some of them, representing around 2% of the scam amount, held on to the proceeds for years, even as victims were suffering. The Government, nor the courts, nor the regulators nor the investigating agencies care about the victims. Even though a Court ordered the payment of the 2% to victims, over the next 3 months (why so long when thousands of crores are distributed in a day using direct benefit transfers??) after a handful received their bit the distribution was stopped by another court on a complaint of a ‘small investor’ who demanded full payment.

No country defines ‘small investor’ or gives unequal rights. If, for example, the richest Indian had invested Rs 9 lacs (some bureaucrat has arbitrarily given a Rs 10 lac limit for a small investor), he would get priority whilst a genuinely small investor had invested Rs 11 lacs, his life savings, he would be waiting for recompense.

The bureaucrats are not going to change. Investors should learn from farmers and protest, not in person, but by transferring their bank balances to other, better run, banks.

The coming year, 2021, would be one of great change, politically, economically and technologically. The last is important, for the new technologies of the 4th industrial revolution would be rolled out. This would impact jobs and would require reskilling as new ones are created.

As an example, the market cap of Tesla today is greater than the combined market cap of all leading auto companies, like VW, Toyota, Ford, BMW etc. though its profit is lower. The technology change towards Electric Vehicles has driven that. A

It is the job of Governments to forewarn and prepare the people for coming changes. Yet, at each election rally, every political party promises more jobs. And we do little to prepare for the new technologies. We are yet to get over the legacy systems that have held us back, and continue doing so.

Yet, excess liquidity will drive stock markets higher, and the inoculation of vaccines will lead to an opening up of the economy. So 2021 would see a sharper economic recovery in India than expected. Now, if the Government concentrates on those parameters in the Ease of Doing Business that India lags in, 2021 would indeed be a great year.

COMMENTS