By J Mulraj

Jan 31 – Feb 6, 2021

Poised for growth

It was Winston Churchill who opined that one should not let a good crisis go waste. India has had at least two serious crises, Covid and Chinese belligerence in Ladakh. It has, as indicated in the Union Budget presented last week, learnt some lessons from these crisis.

China, under Deng Xiaoping, discarded communist rhetoric and adopted free markets, with the slogan ‘it matters not if the cat is white or black so long as it catches mice’. He did this 10 years ahead of India, in the 1980s, after China faced a food crisis.

India had a foreign exchange crisis in late 80s, and, with Manmohan Singh as FM, supported by Narasimha Rao as PM, opened up the economy to competition. This ushered in a wave of change, unleashing the entrepreneurial spirits of Indian businessmen, unshackled by years of license-permit rule.

Both countries witnessed huge economic growth, but the 10 year lead China enjoyed made the difference. If one economy grows at 10% year on year, and another, shackled by license-permit raaj grows at 5%, over 10 years the economy of the former is 60% higher.

Over four decades the gap has grown wider and today, China’s nominal GDP is 5.7 times that of India. This gives China the financial muscle to spend more on military (hence the belligerence with India and other countries), on infrastructure (China has global dominane in steel and cement capacities, and uses this to promote its BRI (Belt & Road) projects. And thus wins support at international fora like United Nations and WHO.

In the 80s, when China had started its economic growth based on freer markets, India was embroiled in scandals like the St. Kitts, HDW submarine, Bofors, fodder and cement, etc. If our polity places personal enrichment ahead of the nation, the result is weakness, manifested decades later. It is interesting how the Mandal commission was introduced months after the St Kitts scandal erupted, and coincidentally helped divert attention. But that only helped divide the economic job pie instead of expanding it.

It is lamentable that our polity opposes reform measures they once themselves proposed, merely to exercise their democratic prerogative. In so doing, they are merely holding back India’s economic progress.

Lessons from these crises are many.

Stability of tax rates and policies is one. Thankfully, this is being done as this gives entrepreneurs and individuals the comfort of planning their businesses and lives. It also signals a reduction in corruption to manipulate such tax rates for competitive advantage.

Self reliance, or atmanirbharta, especially in defence sector. It is a tragedy that previous Governments did not join hands with the private sector to manufacture defence equipment in India, depending, instead, on expensive imports. With the added risk of this dependence being used by the supplier for political agendas. The probable reason, judging by the plethora of scandals from defence import deals, was the likely kickback such deals provided.

It is true that China’s economy is now 5.7 times larger than India and we cannot match its defence spend. India can be comforted by, and should follow the lead of, Russia, which gives the US a run for its money in defence technology. The US economy is 12.5 X Russia’s. It does this with a sharp focus on its strategic requirements and a far lower cost of manufacture.

The FM seeks to give a big boost to infrastructure spending to kickstart economic growth, including in Roads, Railways, Ports and Waterways. The spend will be partly funded by monetisation of existing assets like InvITs (Infrastruture Investment Trusts) and REITs (Real Estate Investment Trust). These are special purpose vehicles into which income generating assets, like roads, electricity grid investors. The retail investors are assured of a dividend distribution of over 90% of the income earned by the assets, giving them a better return than, say, a fixed deposit, plus a chance of appreciation. Brookfield, e.g. recently launched a REIT which gave a pre tax return of 7.95%.

The Government has also shed its mental and ideological block over selling state owned assets. This columnist, among several others, has been advocating, for at least 15 years, sale of the plethora of public sector banks, arguing that the Government needs only 2, at most 3, PSBs to safeguard our financial system.

Finally, in this year’s budget, FM Sitharaman announced the privatisation of 2 PSBs. GOI will also create a Bad Bank into which assets (bad loans) of Rs 2 lac crore would be transferred, and, over time, sold to asset reconstruction companies (ARCs).

Implicit in this plan is the need to speed up our judicial system. The ARCs would buy stressed assets only if the judicial system does not slow down the sale of these assets such as to make the exercise unviable.

The Government is setting up 7 special textile parks to attract international FDI. Textiles is a sector with a high potential for jobs, and one in which India has advantages. India leads the world in production of cotton (6.4 m. tonnes in 2019, Staista). It has capacities, and skills, in spinning, weaving and designing, and also manufactures textile machinery.

Funds will also be raised from equity divestment of stakes in LIC, Air India and a general insurance company, and others. GOI has a huge pile of such deadwood to get rid of. After privatisation, which puts money into GOI hands, the assets are expected to give better returns on capital invested, thereby boosting GDP.

Hence it is forecast that GDP growth in India for 21-22 would be upward of 11%. Fiscal deficit is pegged at 6.4%, but this is after accounting for losses of Food Corporation of India which, earlier, used to be treated as an off balance sheet item and not taken as a part of the Fiscal deficit. The Government is thus being more transparent, kudos to it.

The stockmarket welcomed the budget, as well as the non-tinkering with tax rates, and the sensex rallied 9.6% to end at 50,731.

One irksome area is dispute resolution. India is to appeal the arbitration ruling against it in the Vodafone case, and is yet to decide in the Cairn case. When seeking to attract more foreign direct investment into India, these issues will be a major stumbling block.

GOI also needs to clarify its stand on crypto currencies fast. It announced, last week, that it would propose a bill to introduce a sovereign crypto currency and ban all privately issued crypto currencies. This undermines the logic of privately issued crypto currencies like Bitcoin. The supply of bitcoin has, under the programme creating it, been capped at 21 million coins (it is 18.5 m now) and this makes it attractive. Fiat money, whose supply is Government controlled, has no limit on supply.

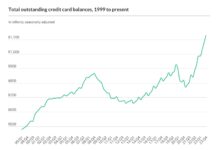

Earlier the supply was tethered by the Government’s gold holding but, after Richard Nixon removed gold backing of the USD, Governments have been free to print as much as they wish.

Unrestricted printing of money has a price, which will be paid by a future generation. In essence we borrow from our children and grandchildren to live an easier life.

The excess money supply finds its way into assets, inflating their prices. For a Government to say it will issue a centrally issued digital currency the risks of resultant asset bubbles does not disappear.

In 2014 the Canadian Senate invited a crypto currency expert, Andreas Antonpoulos to educate it on crypto currencies. This was 6 years ago! During this time, in India we vacillated between whether investing in crypto currency was legal or not (still not clear!). Can India also not invite views of experts, presuming that our polity is not so intellectually superior as to disdain it? For sure, all wisdom does not reside in our bureaucracy alone, and other views of recognised experts should be taken. Shouldn’t it?

It is great that the Government is taking steps to turn the crisis into an opportunity. A lot of further steps need to be taken, so that India can grow in double digits and seek, like the tortoise, to reduce the gap that the Chinese hare has taken.

The stock market will be on a bullish path, following economic growth. The risks are geopolitical, including the hot spots of China in the South China Sea and in Ladakh, and Iran. One has to see how the new leadership in USA will handle these. Perhaps it is better to be bullishly cautious than to be cautiously bullish.

Picture source: https://www.passionateinmarketing.com/is-this-crisis-been-wasted-by-your-brand/

COMMENTS