http://www.moneycontrol.com/news/economy/policy/when-will-the-budget-provisions-actually-liberate-this-yellow-metal-2507939.html

Budget 2018 and gold — a long way to go yet

To understand how significant the provisions of the Budget are, one must go back in the past where gold was largely been treated only as a commodity – albeit a precious one.

Gold prices are slipping. But don’t be under the illusion that Indians are losing their appetite for the yellow metal.

Each morning brings headlines about gold being seized at India’s airports. Sometimes it is concealed inside buttocks, sometimes within the frame of a wheelchair, and mostly brought into India by the flight crew, who are seldom frisked at the security gates.

Irrespective of the mode of transportation, the message is still loud and clear. Gold smuggling is immensely profitable. That explains why people who genuinely want the gold industry to be robust in India are not too excited by the provisions made in the recent Budget. But the mood within the smuggler community remains upbeat. They know that smuggling in of gold will remain immensely lucrative even now.

To understand how significant the provisions of the Budget are, one must go back in the past where gold was largely been treated only as a commodity – albeit a precious one. For decades it was therefore kept under the ministry of consumer affairs. Except for few policy announcements like customer duty rates, the finance ministry did not bother itself the development of the gold market.

It then began looking at gold as a non-financial asset, even a non-financial investment.

It is only now that gold is being regarded as a financial investment – an asset class by itself.

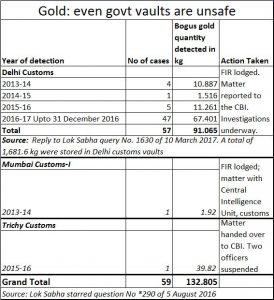

One of the immediate implications of gold being regarded as a financial investment is that it comes under the purview of the RBI. It is now treated as money. All the customs vaults from which theft of gold has been reported now come under the jurisdiction of the RBI. Even seized gold will now get accounted for, and possibly move into vaults that operate under the guidelines laid down by the RBI. That could reduce the theft of gold from the vaults of the customs department.

But more interestingly, the budget now legalises the granting of loans against gold bullion and coins, which was expressly forbidden till now. “What the budget does is that it seeks to bring out investment gold to play a part in the financial markets,” explains Subhash Chandra Garg, Secretary, Economic Affairs, Ministry of Finance, in an exclusive interview with Moneycontrol.

Of course this will mean several things. First, it allows the government to use a vast plethora of laws to standardize the quality of gold being sold in the markets. It can effectively even use clauses relating to counterfeit currency to arrest (without bail) anyone trying to palm off substandard gold. One of the provisions is the use of laws under the FICN (Section 489-A- Counterfeiting currency-notes or bank-notes, of the Indian Penal Code allow for life imprisonment and make the act of fraud a non-bailable offense.

But to standardise gold, the government has to work with gold refineries, and see that quality standards are scrupulously followed. Expect gold refineries to become more active than ever before. But the budget does not specify how the gold standards will be enforced – through the use of FICN provisions, or through some other means. Moreover, incentives for refineries too have not been spelt out.

Obviously, none of these measures will bear fruit unless the government also moves in quickly to reduce the import duties on gold. Garg admits this. “Yes, we see a need to reduce gold smuggling. We also understand that having an import duty rate of 10% on gold imports actually becomes an incentive to smuggling. We are working on ways to address this problem,” he explains. This is because any import duty of over 5% makes smuggling in of gold very lucrative. After all, it is a high value, low-volume metal. And even though the customs do seize gold that is being smuggled in, the total volume of seizures does not exceed 5% of the gold being smuggled in each year.

Obviously, none of these measures will bear fruit unless the government also moves in quickly to reduce the import duties on gold. Garg admits this. “Yes, we see a need to reduce gold smuggling. We also understand that having an import duty rate of 10% on gold imports actually becomes an incentive to smuggling. We are working on ways to address this problem,” he explains. This is because any import duty of over 5% makes smuggling in of gold very lucrative. After all, it is a high value, low-volume metal. And even though the customs do seize gold that is being smuggled in, the total volume of seizures does not exceed 5% of the gold being smuggled in each year.

During the last four years, at least 280 tonnes were smuggled in. The actual numbers, say trade sources could be a around 100 tonnes annually). That gives the total quantum of smuggled in gold to be around Rs.25,000 crore (when you multiply 1 lakh units of 10 grammes by an average price of Rs.25,000 per 10 gm). A 5% profit on this volume translates into Rs.1,250 crore per annum at the very minimum. That is exceedingly good income for any business. Naturally, smuggling becomes quite attractive.

And despite the high decibel noise surrounding gold seizures, it is worth bearing in mind that in three years, the authorities could seize only 7 tonnes of gold.

The government wants to set up gold exchanges in India so that the clandestine trade in this yellow metal becomes mainstream, and makes India wealthier in the process.

The government wants to set up gold exchanges in India so that the clandestine trade in this yellow metal becomes mainstream, and makes India wealthier in the process.

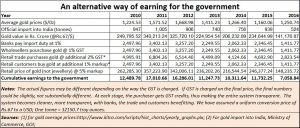

But the acid test will remain the reduction of import duties. This author has suggested a scheme which would benefit both India and the trade enormously. Such a scheme would allow gold to be imported by designated banks and private players (but with at least 50% of the gold volume coming through banks. All imports through these channels would invite an import duty of just 1% (see table).. Thus gold imported through other channels would invite the current rate of 10%.

The banks and designated importers can sell them to gold wholesalers after charging them a GST of say another 1%. These wholessalers could sell them to the retail trade with an additional net GST of 2% (after input credits are applied). The eventual customer would have to pay a net GST of just 1%. This would ensure that the entire levy on taxes on gold is not more than 5% end-to-end. That could reduce the lure of smuggling, and make the gold trade vibrant.

As Garg puts it, “Till now the focus on gold was to minimize its use and reduce its import. The duty rates were kept at 10% to discourage import. But we have also seen that at this level, smuggling in of gold also takes place. . . .To ensure that gold moves out into the economic mainstream we want to introduce several measures right from introducing gold deposit accounts, to introducing gold vaults, to having gold exchanges. And while the KUB Rao report does not talk of having a gold regulator, we think this will remain a regulated business.”

Even Garg agrees that the idea is to make this industry vibrant, and to bring out the gold which remains hidden away.

COMMENTS